PUBLIC PARTICIPATION IN POLICY FORMULATION

TREASURY PS DR. KIPTOO UNDERSCORES THE NEED FOR PUBLIC PARTICIPATION IN POLICY FORMULATION

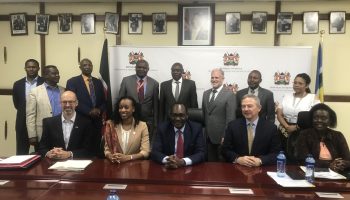

National Treasury Principal Secretary Dr. Chris Kiptoo has called on members of the public to make known their views on Amendments to the Public Finance Management (PFM) Act, 2012 and its Attendants Regulations, in the on-going public participation exercise.

In his remarks read by Treasury Director Accounting Services Jonah Wala during the Nairobi regional public participation exercise, the PS underscored the need for public participation as provided for under the Constitution.

He said the exercise being undertaken in different regions across the country will provide an opportunity for Kenyans to interrogate the proposed amendments and make submissions on their views for consideration, and emphasized on the need for citizen involvement in policy making and implementation so as to strengthen and deepen good governance.

PS Dr. Kiptoo noted that the amendments aim at setting a debt anchor in line with with international best practices and provides a clear and consistent framework for managing the country’s debt, and allows the Government to plan for the long-term.

He said the Government has put in place various strategies to bring it down to the new debt anchor, such as reducing unnecessary expenditure, increasing revenue collection, and pursuing sustainable debt financing options among others.

The proposed amendments on the PFM Act and its attendants Regulations are meant to harmonize the definitions of the word ‘Public Debt’ in the PFM Act, 2012 with its attendant Regulations to be consistent with Article 214 (2) of the Constitution of Kenya and to define ‘financial obligations’ as referred therein to guide the operationalization of the debt limit.

Further, the amendments seek to replace the Kshs. 10 trillion public debt numerical ceiling with a debt anchor set at 55 percent of the Gross Domestic Product (GDP) in the present value terms.

By setting a debt anchor, the Government will commit to a sustainable level of debt in line with international best practice, set by the International Monetary Fund (IMF) Debt Limit Policy- that is linked to debt sustainability which will subsequently reduce the risk of default.