LAUNCH OF THE KENYA NATIONAL ENTREPRENEURS SAVINGS TRUST

The board of trustees for the Kenya National Entrepreneurs Savings Trust (KNEST) was officially launched today, with a major mandate to oversee the running of the scheme registered last year.

The trustee will be required to develop short-term and long-term savings mechanism to meet the unique and diverse needs of the informal sector as envisioned in the bottom up economic model.

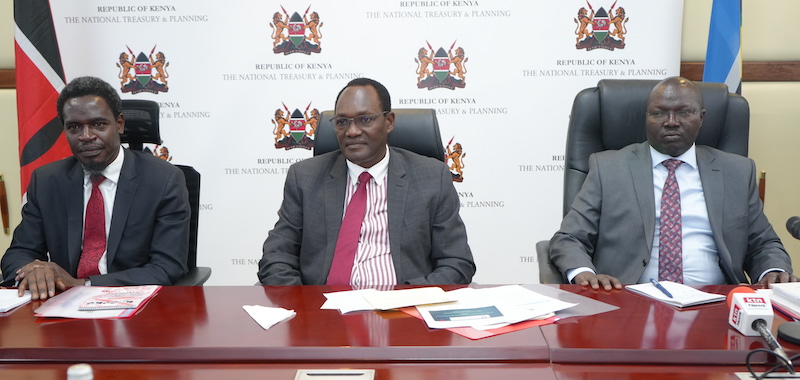

The launch was officiated by the National Treasury Principal Secretary Dr. Chris Kiptoo on behalf of The National Treasury and Economic Planning CS Prof. Njuguna Ndung’u.

In a speech delivered on his behalf by PS Kiptoo, CS Ndung’u said the government recognizes the role of Small Medium and Micro Enterprises (SMMEs) and the need to establish a saving scheme to addressing the plight of the marginalized population at the bottom of the pyramid.

Prof Ndung’u said the informal sector workers in Kenya constitute more than 80 percent of the total workforce and contribute about 34 percent of the GDP. However, they are not adequately covered by the available formal savings mechanism, because the traditional savings arrangements are not designed to meet their unique needs as they are heterogeneous, hence the need for Government intervention.

He said the board will play a critical role of ensuring the success of the scheme that will offer sufficient domestic savings to cushion Kenyans at retirement.

On his part, PS Kiptoo called on the board to ensure the scheme succeeds by leveraging on modern technologies such as digital finance linkages and integrate commitment mechanisms with offerings of long-term savings alongside other financial products to sustainably unlock opportunities for changing long-term savings behaviour of Kenyans.

Cabinet Secretary for the Cooperatives & Micro, Small and Medium Enterprises (MSME) Development Simon Chelugui, welcomed the board saying the scheme will play a critical role in complimenting the Hustler Fund both which aim at improving the life of economically marginalized Kenyans.

CS Chelugui said the voluntary scheme will be strengthened by the government through incentives, to ensure sustainable and inclusive sector specific saving schemes in order to achieve maximum scale up saving.

Retirement Benefits Authority (RBA) Chief Executive Officer Mr. Charles Machira said RBA will offer technical support, supervise and offer advisory to the scheme to ensure more people from the informal sector join the saving space.

The board will consist of six independent members namely Tom Ayieko, Joseph Wanjohi, Martha Opisa, Rachel Leyian, and Ruth Bungei and it will serve a period of three years.

KNEST was identified by H.E. The President Willian Ruto to implement the long-term (retirement) and short-term savings aspects of the Financial Inclusion Fund (Hustler Fund). The scheme has a mandatory savings channel which will anchor the savings component of the Hustler Fund and a voluntary savings channel for those who do not wish to borrow.