KENYA PIPELINE PAYS OUT KSH. 5 BILLION INTERIM DIVIDENDS TO THE GOVERNMENT

The government received an interim dividend payment of Ksh. 5 billion from the Kenya Pipeline Company (KPC), the dividend payment follows a 21% increment in KPC’s profitability to Ksh. 7.6 billion in the financial year 2022/2023 compared to Ksh. 6.3 billion in the previous year.

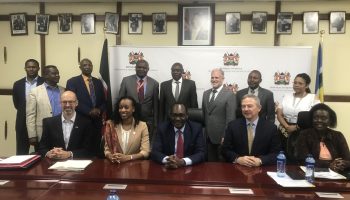

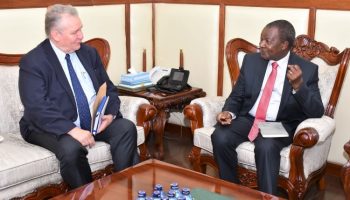

Speaking during the cheque handover ceremony at KPC Headquarters in Nairobi, The National Treasury and Economic Planning CS Prof. Njuguna Ndung’u commended KPC for being the leading highest State Corporation in paying out dividends to taxpayers.

The CS called on other State Corporation to make use of the government investments in their sectors to deliver a return on investment to taxpayers.

“Most parastatal are still dependent on the National Government for their operations. This means that taxpayers have to incur an additional burden in supporting and bailing them out due to poor performance. It is however noteworthy that KPC continues to deliver positive results on an annual basis and remains a self-funded corporation that delivers a return on investment to its shareholders who are the people of Kenya. The Ksh. 5 billion in interim dividends is the highest dividend paid by any state corporation.” said Prof. Ndung’u.

On his part, Energy and Petroleum Cabinet Secretary Davis Chirchir commended KPC for being consistent in delivering positive returns to taxpayers noting that KPC plays a strategic role in ensuring the country’s fuel security and that of the wider East African Region is guaranteed.

“As KPC marks 50 years of service delivery to Kenyans and the wider East African Region, it remains the most profitable State Corporation with both strategic roles and revenue targets. This strategic decision is meant to enable KPC to enhance the petroleum supply chain infrastructure and thereby result in the security of supply and cost-efficiency through reduced demurrage costs.” CS Chirchir added.

CS Chirchir called on KPC to diversify its products and expand its reach to the entire region and added that fuel security is a critical driver of the economy and that is why the government continues to invest in KPC by entrusting it with key assets.

KPC Board Chair Faith Bett-Boinett said the Ksh5 billion interim dividends was passed via an AGM declaration two weeks ago, and the payout is evident that KPC embraces sound business fundamentals to achieve desired results.

She said, “We are paying from a position of strength not compulsion, bolstered by sound strategic decisions and operational efficiencies including cost-cutting measures, KPC witnessed a remarkable 21% jump in profits (Ksh. 7.6 billion up from Ksh. 6.296 billion) compared to the previous period ending 30th June, 2022.”

KPC Managing Director Joe Sang noted the company will explore options to diversify its products, leverage on both its expertise in the oil and gas sector and its existing infrastructure to expand KPC capacity.

“Apart from growing our normal transportation and storage of petroleum products, we are looking at growing other business streams such as our Fiber Optic Cable (FOC), Morendat Institute of Oil and Gas (MIOG) and investments in Liquefied Petroleum Products (LPG) in the next Financial Year (2023/2024). The measures are aimed at enhancing the company’s resilience to overcome the volatile future. We are also placing additional emphasis on the export markets across East Africa and are working to fully operationalize and exploit the Kisumu Oil Jetty to make KPC the most cost-effective and competitive transporter of petroleum products across the region.” Mr. Sang added.